Don’t Sweat The Dip! Ethereum 15% Price Slump Could Spark Epic Comeback — Analyst

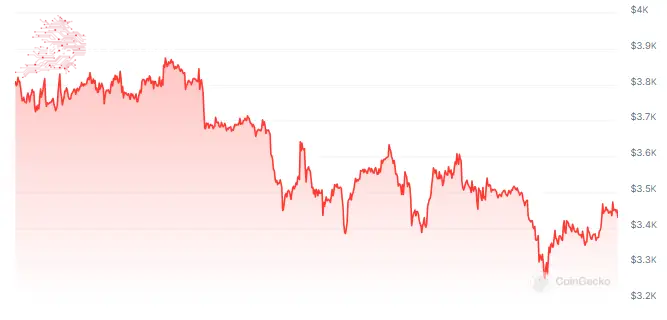

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a significant decline in value recently. Over the past month, its price has dropped by 15%, leading to concerns among investors about the future of this digital asset. The current situation raises questions about whether this downturn signals a prolonged decline or if it is merely a temporary setback before a potential recovery.

Despite the price decrease, some analysts remain optimistic about Ethereum’s prospects. Prominent cryptocurrency analyst Yodhha has identified technical patterns that may indicate a forthcoming reversal in Ethereum’s fortunes.

Ethereum: Signs Of Potential Reversal?

Yodhha’s Analysis highlights two key chart formations: the Inverse Head & Shoulders and the Falling Wedge (also known as a Bull Flag). The Inverse Head & Shoulders pattern, a common indicator of a market reversal, suggests that a downtrend may be shifting towards an uptrend. The Falling Wedge pattern, which occurs when the price is temporarily confined within a narrowing range, often precedes a breakout and continuation of an uptrend.

$ETH

Anytime now… pic.twitter.com/qF4uiWquFI

— Yoddha (@CryptoYoddha) June 26, 2024

These technical indicators, along with other markers, suggest that Ethereum may already be on the verge of entering bullish territory. Yodhha’s Analysis also identifies specific price levels that, if surpassed, could lead to a significant price increase for Ethereum.

Impact Of Regulatory Developments

In addition to technical Analysis, regulatory developments play a crucial role in the cryptocurrency market. One of the most anticipated events is the potential approval of a spot Ethereum Exchange-Traded Fund (ETF) by the US Securities and Exchange Commission. Industry experts speculate that this approval could come as early as July 4th, a date that could mark a significant milestone for Ethereum.

Financial services firm StoneX predicts that the approval of an Ethereum ETF could lead to a substantial increase in the cryptocurrency’s price. According to StoneX, Ethereum could see a price rise of up to 40% within two months following the ETF’s launch.

This surge in investor interest could help Ethereum recover from its recent slump and reach new price highs. StoneX’s projections suggest that Ethereum’s price could range from $2,140 to as high as $12,620 over the next two years, even under more conservative scenarios.

Investment Considerations

The recent decline in Ethereum’s price may offer a compelling opportunity for investors. With technical indicators suggesting a possible bullish reversal and the potential for significant regulatory developments, Ethereum’s future could be brighter than its current performance suggests. Investors should consider these factors when evaluating their investment strategies in the cryptocurrency market.

Featured image from HCA Healthcare Today, chart from TradingView

Comments

Post a Comment