HSBC Enables Bitcoin, Ethereum ETF Trading in Hong Kong

Bitcoin exchange-traded funds (ETFs) have garnered significant attention within the crypto industry lately. This is following the plethora of platforms seeking approval for such products in the United States. Now HSBC, the largest bank in Hong Kong, has begun permitting its clients to buy and sell Bitcoin and Ethereum ETFs.

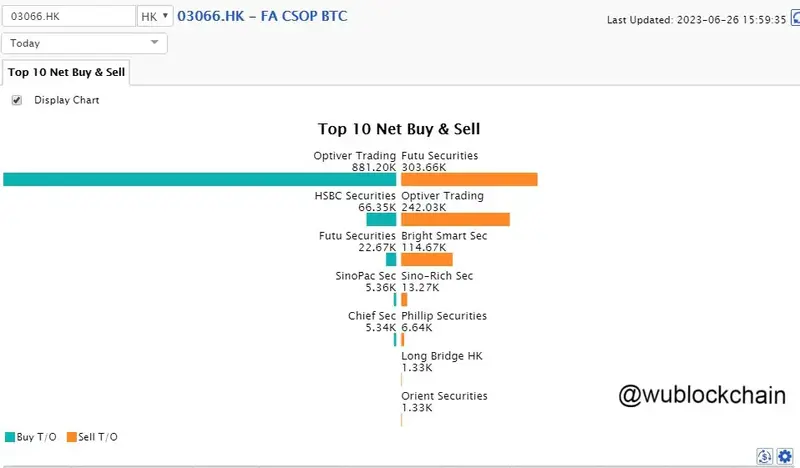

HSBC’s recent announcement represented a momentous move. This is because it is the first bank in Hong Kong to facilitate ETF trading. This development is expected to broaden the access of Hong Kong residents to cryptocurrencies. Currently, investors in the Hong Kong market have the opportunity to explore cryptocurrency ETFs like the CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

Furthermore, there were rumors earlier this month that Hong Kong regulators were urging HSBC and Standard Chartered to onboard crypto clients. However, banks have displayed caution and reluctance in engaging with cryptocurrency exchanges due to concerns related to money laundering and potential involvement in other unlawful activities. HSBC’s recent move comes after two weeks.

HSBC rolls out ‘Virtual Asset Investor Education Centre’

Hong Kong made quite some news over the last couple of months. The special administrative region has been taking the regulatory route to embrace the industry. Along with the news of HSBC’s Bitcoin and Ethereum ETFs, Chinese journalist, Colin Wu, revealed that the bank rolled out the Virtual Asset Investor Education Centre.

Wu tweeted,

“At the same time, HSBC launched the Virtual Asset Investor Education Centre, investors need to read and confirm the educational materials and risk disclosures in the Virtual Asset Investor Education Center before investing in any Virtual Assets-related products through HSBC HK Easy Invest app, HSB CHK Mobile Banking app and online banking.”

Comments

Post a Comment