Swipe right: A Tinder-like approach to venturing into DeFi and Web3

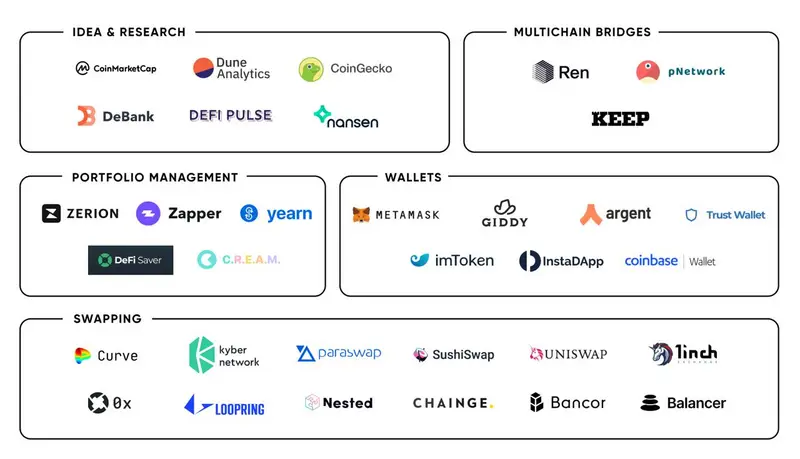

Investors use multiple tools to explore, invest and manage decentralized trading. This platform brings together the best of all worlds in one simplified interface to make investing in Web3 easier for all investors.

Legendary investor Warren Buffett once said that we should never invest in businesses that we don’t understand. Web3 is a new market and it’s evolving fast. While understanding all intricacies of decentralized networks might be unachievable, this shouldn’t lead to lost opportunities.

Ways to participate in DeFi and Web3

Investors can get exposure to DeFi in so many ways. Here are some of them:

- Investing in digital assets. Crypto holders can explore digital assets on decentralized exchanges (DEXs) and build noncustodial portfolios, meaning that they hold tokens in their personal wallets while interacting with the apps. Crypto tokens are highly volatile and prone to price manipulations, but there is always something to explore.

- Providing liquidity. DEXs don’t rely on market makers and have no order books. Instead, they have liquidity pools, where users can deposit their tokens in exchange for rewards paid from transaction fees. This practice is often called yield farming, which is a broader term.

- Staking. Crypto holders may stake their tokens with blockchains that use a version of the proof-of-stake (PoS) algorithm. In this way, they contribute to the network’s security and operation. Some DeFi protocols, such as Lido, make a staker’s life even more exciting by letting them explore more yield-farming opportunities while having their tokens locked for staking.

- Lending. Investors can lend crypto funds with decentralized lending apps.

- Investing in DeFi projects. New DeFi projects deployed by teams of developers and entrepreneurs may seek funding to succeed with the initial launch before adopting full decentralization. Investors can get exposure to such projects either directly or through launchpads.

The many ways and steps to invest and get exposure to Web3 finance can be intimidating, and the fact that blockchain is a fragmented industry adds to the pain. The good news is that user-friendly DeFi solutions are starting to show up.

What are the current pain points for DeFi?

Source: Dyor

Decentralized finance (DeFi) and Web3 are empowering communities and investors by providing decentralized ecosystems and trustless, peer-to-peer (P2P) interactions. This all sounds exciting, but non-tech-savvy investors are often disappointed to find out that getting exposure to DeFi opportunities is more complicated than doing business on Web2.

The persisting praise of DeFi and Web3’s potential on social media is fueling high expectations, but the complexity of decentralized interactions may be confusing.

In traditional finance, the products and services are offered by centralized entities that operate within a well-established legal framework. In DeFi, the rules are enforced by smart contracts and algorithms, which are difficult to understand for novices. Whom should you call when something is not working properly? There is no customer service and no assistant on the other side of the screen.

Without guidance or a user-friendly platform, becoming an active participant in Web3 is not very intuitive. Investors have to use many tools to explore, research and monitor digital assets, translating into lost time, missed opportunities and less capital allocated to projects that might end up being lucrative. This is why many investors are wary of the Web3 space.

An all-in-one DeFi platform for everybody

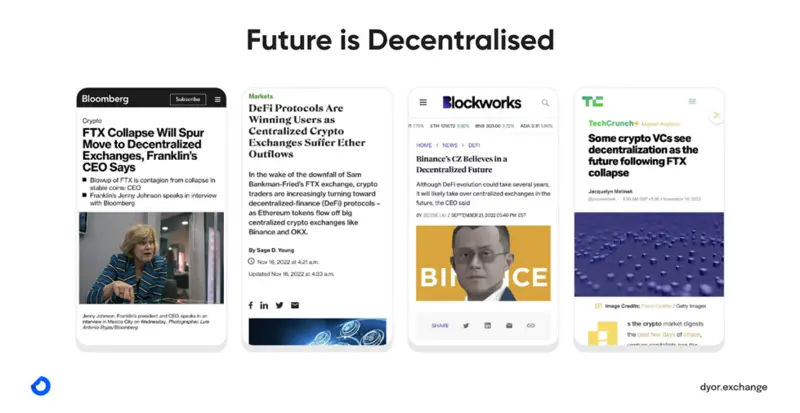

To simplify the investment process, crypto holders can leverage platforms that offer Web3 opportunities through Web2 practices. Dyor is building a decentralized social investing app to help new investors discover and invest in high-quality Web3 and DeFi projects easily, through a seamless Swipe interface and gamified social investing. Think Robinhood meets Tinder, but it is Web3 - 100% self-custodial and permissionless.

Dyor co-founder Markuss Jonans explained:

“Everybody deserves self-custodial, permissionless finance—it is the ultimate financial freedom, and that is what our technology brings to the table. Dyor is committed to making it happen by simplifying the Web3.0 investing experience and making it accessible for all investors.”

Source: Dyor

Dyor offers several Features that make Web3 investing easier:

- A user-friendly “swipe” interface. Purchasing Web3 assets is made simple with a Tinder-like swiping experience — right to invest, left to skip and up to add to the watchlist. Instead of romantic partners, you get to browse through Web3 projects.

- Social investing, gamified. Users can engage with other investors, compete in trading challenges and achieve portfolio milestones.

- Easy discovery and decision-making. The app offers consolidated real-time price alerts, market news, user-generated research and statistics to encourage better investment decisions.

- One-swipe multichain investing. Investors can interact with multiple chains, including Ethereum, BSC and other EVM-compatible chains, seamlessly using one wallet. They can purchase assets with a card and other payment methods, with no gas fees or bridging required.

- Self-custodial wallet. Dyor’s in-built multichain wallet is self-custodial, meaning that users hold private keys. Users can set it up or import an existing wallet without going through KYC procedures.

- Seamless portfolio management. Users can manage holdings, transfer tokens, track profits and losses, and receive market notifications. They have access to in-depth analysis and statistics to follow the market pulse.

These Features collectively enhance the Web3 investment experience, closing the complexity gap and aligning with DeFi’s mission of democratizing finance.

In an era where Web3 and DeFi are redefining financial interactions, bridging the knowledge and accessibility gap is paramount. Platforms like Dyor are pivotal in this transformation, seamlessly blending the familiarity of Web2 interfaces with the pioneering benefits of Web3.

As the world gravitates toward decentralized finance, such intuitive tools ensure that every individual, tech-savvy or not, can confidently navigate and capitalize on the vast opportunities that lie ahead.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment