Analyst projects ‘mega bounce’ and ‘fireworks’ for XRP; This is when

In an Analysis shared by market analyst EGRAG on X, he predicts a XRP rally in the beginning of next year. This surge has the potential to push the cryptocurrency to reach the $27 price mark, signifying a significant increase of approximately 4,853% from its current value.

EGRAG’s projection, outlined in a recent Analysis of XRP, draws upon historical patterns observed during previous bull markets. The analyst highlights that the past bull run witnessed Bitcoin (BTC) surging by 23 times, while Ethereum (ETH) saw a remarkable 58-fold increase.

The analyst underscores that XRP also has the potential to achieve similar gains, but it has faced resistance primarily due to price suppression resulting from the US SEC’s lawsuit against Ripple.

XRP fundamentals

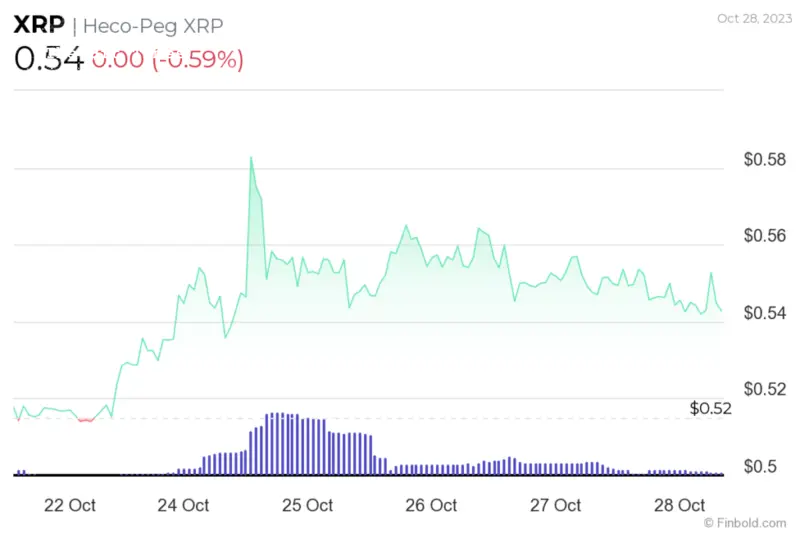

XRP, ranks fifth by market capitalization and is currently priced at $0.54, has been a prominent player in the cryptocurrency market for over a decade.

Created by Ripple Labs, it aims to revolutionize global money transfers and provide an efficient alternative to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system, offering faster, cost-effective international transactions.

In a year marked by considerable volatility in the cryptocurrency markets, XRP has demonstrated resilience and delivered notable returns for investors.

Over the past 12 months, the token has experienced a remarkable surge of 24%. This commendable performance means it has outperformed 76% of the top 100 cryptocurrencies.

Vital resistance levels

In late 2021, while the broader cryptocurrency market reached new highs, XRP struggled to gain momentum. Analysts like EGRAG attribute this bearishness in late 2021 to the lingering effects of the SEC’s lawsuit, which led several exchanges to halt support for XRP.

With XRP having received legal clarity following Judge Analisa Torres’s ruling on July 13, EGRAG believes the asset is poised for a significant upswing. According to the analyst, when XRP embarks on its next growth trajectory, it will unlock pent-up potential.

EGRAG provides a monthly XRP chart to substantiate his Analysis. This chart outlines the potential path for XRP to reach the ambitious price target of $27, which includes a series of resistance levels, notably the “next macro resistance.”

EGRAG predicts a potential 40-fold increase for XRP when the asset embarks on this bullish journey. He emphasizes that this projected price surge aligns neatly with the Fibonacci level at 1.618, calculated from XRP’s highest price in 2017 to its lowest value in 2020.

The first major resistance level on the chart is at $3.3, coinciding with XRP’s all-time high reached in January 2018. Surpassing this resistance would set XRP on a course to establish new all-time highs.

However, EGRAG identifies the next significant resistance at the $5.5 price point, representing the next macro resistance that XRP would need to overcome during its rally.

Breaking through the $5.5 price level would bring the $13.3 resistance into play, situated at the Fibonacci level at 1.414 level. Conquering this level is crucial for XRP to reach the coveted $27 price point.The history of XRP’s price has seen remarkable highs, steep falls, and periods of steady decline. The future in 2023 remains uncertain, hinging on the final resolution of the SEC case, which won’t be a simple process, according to lawyer Bill Morgan.

The bullish case anticipates favorable legal outcomes, and a positive market environment could raise XRP’s price. Conversely, a drop in interest after legal resolutions or broader market sell-offs could lead to price declines.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment